Staying the Course: Matthews Asia Dividend

Our portfolio managers field some tough questions on Matthews Asia Dividend’s performance, its positioning and what they believe are its unique strengths for investors.

Overview

Sean Taylor, Chief Investment Officer (CIO) designate

To begin with, it’s worth reflecting on the role Asia plays in the global economy and in our portfolios. It is the growth engine of the world. It is a massive supply chain area with innovation and consumer markets and it is increasingly important as a trade area itself. Above all, Asia continues to grow and its emerging markets are projected to grow faster than any other region in the coming years.

The last five years, particularly the last year, have been challenging. COVID and the different speeds that economies recovered stability has led to different cycles. In Asia, the private sector has taken the brunt of the pain, with job losses and a slowdown in activity absent the government support we saw in the U.S. and Europe. At the macro level, the Federal Reserve’s interest rate hikes and the strong U.S. dollar have also been headwinds. Within Asia, the Chinese economy has faced the biggest challenges, enduring regulatory interventions, a deep property slump, financing concerns and a slower than expected recovery from COVID. And when China slows, others slow. Thailand, for example, depends on China for tourism and trade while Indonesia and Australia are big exporters of commodities to China.

“Growth in the region is not only demonstrated in the form of earnings but has also come through in cash flow to investors in the form of growing dividends.”

In spite of these challenges we’ve seen robust growth and good returns in some Asian markets. India has done incredibly well this year. Elsewhere, parts of South Korea and Taiwan have performed strongly; in the case of South Korea, from its rapid expansion in the global electric-vehicle (EV) battery ecosystem; in the case of Taiwan, from its embedded role in hardware supply chains and growing positioning in the nascent artificial intelligence (AI) boom.

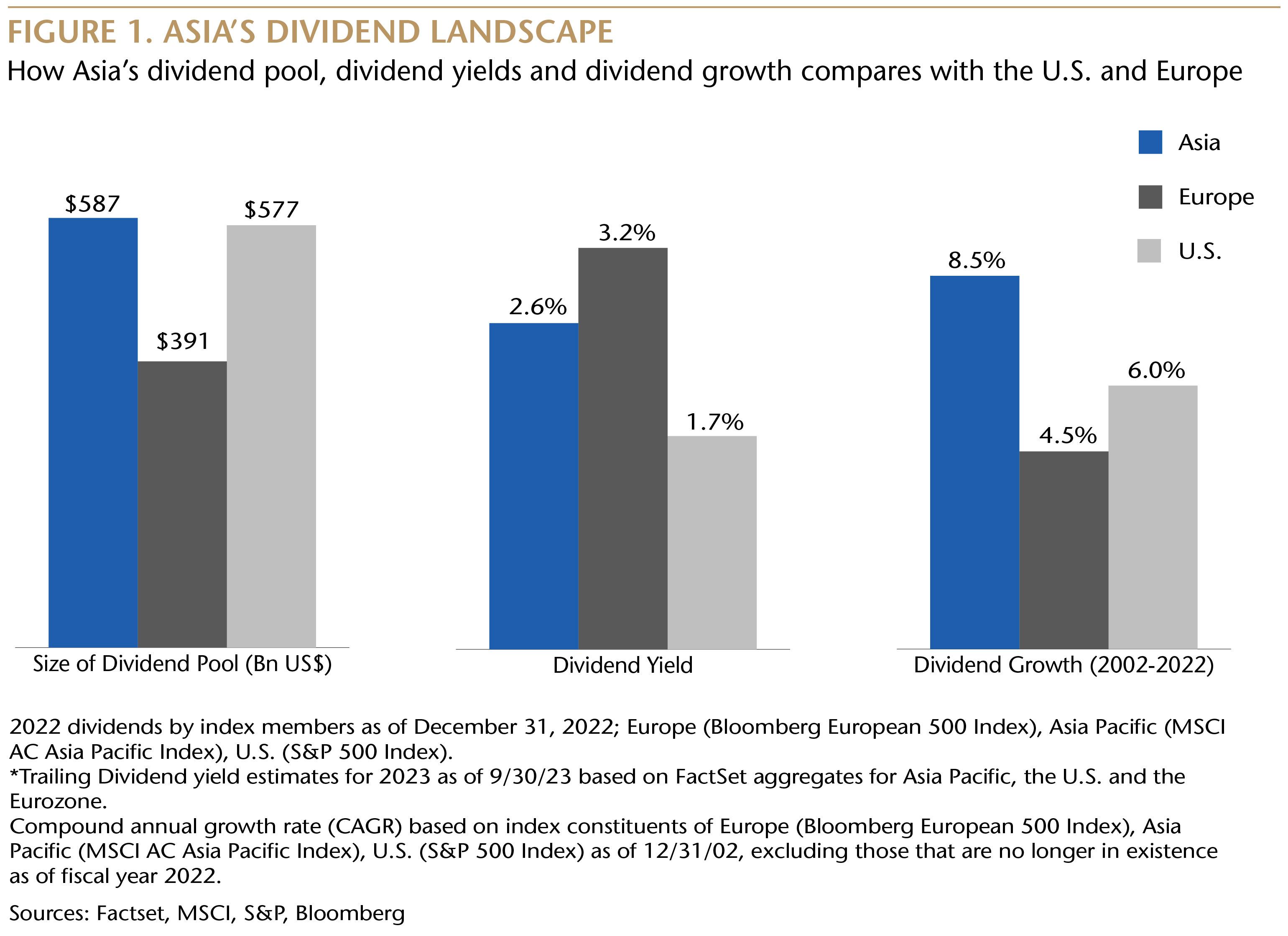

Growth in the region is not only demonstrated in the form of earnings but has also come through in cash flow to investors in the form of growing dividends. Growth in these dividends has averaged 8.5% for Asia over the last 20 years through 2022, in contrast to Europe at 4.5% and the U.S. at 6%. Asia contains a large and growing pool of dividend payers that are globally important companies, in our view, and have the potential to help those seeking reasonable total returns across the economic cycle.

Why Matthews Asia Dividend?

Kenneth Lowe and Robert Horrocks, Lead Portfolio Managers

The strategy has underperformed its benchmark year-to-date. Why is this?

Our stock selection in China and particularly our exposure to consumer stocks in that market were a meaningful detractor to performance in 2023. Stocks exposed to domestic consumption in both staples and discretionary struggled against a disappointing rebound in overall spending in China. Rising competitive intensity in certain areas has also hindered certain businesses.

Japan was another area of challenge in our stock selection. Our holdings delivered, on average, reasonable absolute returns but struggled to keep pace with a benchmark that has delivered strong performance. This was partially due to outperformance and selection in areas where we are underweight, like consumer discretionary and industrials sectors. There have also been disappointing stock specific areas where fundamentals have not delivered in line with our expectations.

The portfolio changed managers at the start of the year. How does the new team plan to address performance which has also lagged the benchmark over the past three and five years?

The prior medium-term performance for the strategy has been disappointing relative to expectations with the portfolio struggling to display much defensiveness against a challenging and volatile market particularly during 2022. Stock selections in the Fund’s two largest markets of China and Japan were disappointing while at a sector level, selection within consumer discretionary and industrials was challenging.

The new team made several alterations to the portfolio at the beginning of the year which resulted in a major turnover of holdings. Importantly, it is not just individual holdings that have been adjusted but country and sector weights, alongside individual position sizes, have also been changed. We believe these changes will provide the potential for improved performance over time.

What have been the main focus of your changes?

At the country level, we reduced exposure to Vietnam and China and increased exposure to areas such as Japan, Hong Kong and Taiwan. At a sector level, exposure to consumer discretionary was reduced alongside industrials while we increased exposure to financials, information technology (IT) and consumer staples. This created far greater turnover in the portfolio than we would anticipate going forward as we are long-term investors who believe that patience is an important component to returns.

We have now transitioned the strategy to one that we think has improved its balance of growth and yield, altered its composition of risk, enhanced its liquidity profile, and raised the average quality of its holdings. This continues to be an ongoing process but we are confident the portfolio is now well positioned to deliver robust risk-adjusted returns over cycles.

Do you see the dividend aspect of the strategy as being a strength for investing in Asia today particular if markets remain volatile and there is a global slowdown?

We believe that dividend investing will continue to remain relevant throughout the economic cycle in Asia. Not only can reinvested dividends contribute a meaningful proportion of total return but we think that they can be an important signal with regards to capital allocation, business quality and corporate governance. These characteristics can also lead to a degree of defensiveness in more volatile environments, although it is by no means always the case. As a portfolio, we attempt to avoid permanent impairment of capital in businesses within which we invest.

The Matthews Asia Dividend portfolio doesn’t seek to maximize its dividend yield and we think it is important that the majority of companies that we allocate capital toward continue to grow. We therefore seek a portfolio that balances both growth and income.

Can you explain some of your positioning today?

The team attempts to focus more on individual stock selection than taking significant views around specific countries or sectors in what is a large investable universe across Asia Pacific. The core of the portfolio revolves around what we believe to be quality companies at reasonable valuations paying some current income with an intention to hold such companies for significant periods of time. Risk management also plays a role within the Fund’s relative weightings.

At a country level, we remain overweight to China/Hong Kong. Concerns over China, including liquidity challenges in the property sector, high levels of debt, soft consumer sentiment, what appear to be dampened entrepreneurial spirits, and elevated geopolitical tensions, shouldn’t be dismissed. However, there are also reasons to be constructive. At a macroeconomic level, there is scope for some continued policy stimulus and more pragmatism, while savings rates are also high. For equity markets, valuations are broadly attractive and projected earnings growth for 2024 is robust. The scale of the Chinese economy and equity market also means that in most environments we are able to find investment opportunities that we believe strike a sensible balance of quality, valuation and growth.

We remain underweight to Japan as we think that there are more appealing opportunities elsewhere. However, we think that Japan can play an important role within the portfolio given the size of the universe, the caliber of certain companies within it, and the potential benefits gained from improving capital returns to shareholders and the possible resumption of more sustained inflation.

When do you expect an improvement in performance?

We believe that the changes made to the portfolio since the new team took over at the beginning of the year are in the best interests for generating long-term risk-adjusted returns. Given the Fund’s patient approach to investing we refrain from predictions around near-term performance expectations. Market moves over shorter time periods are often impacted by issues such as sentiment, positioning and currency movements, among others.

The portfolio has a bias toward what we believe to be quality companies generating solid profitability with sensible balance sheets at reasonable price points while also offering some current income. We typically seek companies where there is both an ability and willingness to pay dividends across varying market environments. Our approach requires a degree of perseverance. Portfolio turnover is anticipated to be somewhere between 10%-50% under normal market conditions, allowing holdings to compound over time.

Why should investors stay invested in the strategy?

Firstly, Asia remains a globally relevant region that has meaningful growth opportunities across a variety of different industries and geographies, while it also has the potential to offer diversification benefits to broader portfolios.

Secondly, the Matthews Asia Dividend Fund is a staple of the firm’s offering of strategies. It is a considered, diversified portfolio aimed at providing income and growth for the long-term investor while potentially mitigating some risk and volatility relative to the broader market. The Fund aims to deliver above market returns to clients over a full economic cycle through a combination of both capital appreciation and income and by investing in what we believe to be a collection of quality companies at reasonable prices with scope for dividend growth.

Uncertain levels of economic growth in many major countries alongside ongoing geopolitical issues leave the possibility of heightened market volatility for some time. We believe that the portfolio’s patient and quality-oriented approach has the potential to provide solid risk-adjusted returns against such a setting.

Why Matthews?Matthews has invested in emerging markets for more than 30 years. This has informed our disciplined investment process which places equal emphasis on risk management and growth opportunities. Our strong risk management over time has improved the durability of outperformance and limited downside risk. We focus on deep company analysis which leads to unique insights and a differentiated portfolio and this focus is across cycles as long-term business owners. We believe earnings growth, valuation and sentiment are what drives markets and within this framework we seek to identify the best bottom-up stock opportunities and ideas that we believe will likely outperform in the current market environment. The Asia Dividend strategy offers expertise across a range of markets and on-the-ground company insight, all underpinned by a robust stock selection and risk management process. |

*Trailing dividend yield is the amount paid per share in distributions over the previous 12 months expressed as a percentage of previous month end price. The 30-Day SEC yield, another measure of yield, reflects dividends earned during the most recent 30-day period. The subsidized 30-Day SEC yield additionally reflects fee waivers in effect. For the performance of the Matthews Asia Dividend strategy please visit the Fund's individual overview page.