China Small Companies: Positioning for China's Policy Tailwinds

As China seeks to achieve “Common Prosperity,” companies which are aligned with the latest policy guidance stand to gain. Innovation, ”technological self-reliance”, and “green energy” continue to be important goals for China, and many smaller companies operating in this space offer strong growth potential.

China Small Companies: Positioned for Policy Tailwinds

Chinese equities experienced a large sell-off following recent regulatory announcements created on technology and for-profit education and were the weakest performing in the region in the third quarter.

While year-to-date through end of September 2021, the MSCI China Index was down -16.59% in U.S. dollar terms, one area within China remained resilient: the MSCI Small Cap Index was up 2.41% during this period. So what has been behind this resilience and where do Chinese equities go from here?

First of all, it’s important to note that regulation in China is nothing new. China’s regulatory philosophy is different to western markets: They tend to not create the regulations at the very beginning, but intervene when they deem it necessary.

Almost every sector of the market, from education to financials, has received government guidance over the past few years to curb excesses in industries. Lately the government has focused on the concept of “Common Prosperity”, a drive to narrow the wealth gap and strengthen and enlarge China’s middle class.

As investors, we think it’s important to be aligned with Chinese regulatory policies and small caps offer a rich opportunity set to do so. With over 5,000 companies available for investing (at US$5 billion or below in market cap), China has one of the world’s largest and most liquid small-cap universes.1

What’s more, some 80% of Chinese small caps are represented by the still inefficient domestic A-share market—an area of the market where close to 60% of companies have zero analyst coverage.1 This represents a fertile hunting ground for active investors like ourselves to “uncover” high-quality companies and offers alpha generating opportunities.

Tapping into “Common Prosperity”

The Matthews China Small Companies Fund focuses on innovative, efficient and sustainable growth companies. It seeks to capture undiscovered growth opportunities that stand to benefit from secular growth trends. One of the most attractive themes reflected in the portfolio is consumer upgrades, the rising demand for quality products and services.

We believe this trend is set to benefit from China’s “Common Prosperity” initiative which aims to raise incomes and grow the middle class. It is estimated that by 2027, 1.2 billion Chinese will be in the middle class category, accounting for up to one quarter of the world’s total2.

One way the portfolio taps the aspirational needs of this segment is via automobile dealers, which derive revenue from car sales, as well as servicing and parts. China accounts for the world’s largest automobile market, with annual sales of more than 20 million cars3.

In our view, low car penetration rates, combined with increasing urbanization and rising household income, should continue to provide ample tailwinds for automobile dealerships, especially those that offer premium vehicles and services.

A Greener China

Opportunities associated with a “greener China” is a key theme in our portfolio. In our view, electric vehicles (EVs) and renewable energy can help China achieve its energy self-sufficiency plans and goals to achieve carbon neutrality by 2060. To do so, the country needs to embrace renewable energy and green technologies, from electric vehicles to solar panels and wind turbines.

EV adoption has been growing rapidly in China and China is already the largest and fastest growing market for EVs. The country has an admirable target when it comes to new energy vehicles (NEV)—20% of all new car sales to be electric by 2025, and 40% of new vehicles sales to be NEV by 2030 and we see a number of investment opportunities related to EV-battery manufacturing.

Solar inverter companies are another fast-growing area where the portfolio has exposure.

In China, energy companies are mandated to source a certain part of their energy mix from renewables. As a result, a lot of solar panel consumers are energy companies and they build utility scale projects.

This, however, is just the beginning. To reach its goals, China needs to more than double its wind and solar power generation capacity in the coming decade. Rooftop solar or developments in smart grid technology could be ways to narrow the gap and they have been strongly supported by recent Chinese policy initiatives.

Furthermore, China is largely end-to-end self-sufficient in both EV and solar industries. This enables them to control these value chains and drive down the cost curves. In the EV battery value chain, for example, costs have come down meaningfully over the last decade.

Living longer and better

Overall, we believe that China’s domestic localization and import substitution push creates attractive prospects for small businesses. In many industries, small companies compete with big heavyweights foreign firms for local market share. With national policy support, we believe smaller company are well set to fill the domestic gap.

We see opportunities in many areas of technology and health care, spurred by a continued influx and a growing critical mass of talents in China. Health care is a very sizable market in China and the sector is subject to micro reforms, which aim to make health care more affordable and pharmaceutical companies more innovative.

Research and development (R&D) spending among many pharmaceutical companies has risen substantially in recent years. Often dedicated contract research organizations (CROs) are the beneficiaries of this increase. In our portfolio, we have exposure to CROs, which provides support to pharmaceutical industries in the form of research services outsourced on a contract basis.

We also see opportunities in robotics and automation. Given China’s aging demographic shifts and increasing wages, more robotics and automation solutions are used in today’s factories and provide interesting opportunities.

In addition, factories are grappling with a shortage of workers as many have moved to more metropolitan areas and into employment in the services sector. We believe 6-axis robots, a type of articulated robot which is largely used in industrial manufacturing, can help factories become more efficient and reduce their reliance on workers. China still imports 80% of its 6-axis robots, so we think local providers can build on their current market share.

Another key area we like is hyper-connectivity and the development of technological innovation in domestic firms, also known as indigenous tech innovation. China’s large local market presents an unprecedented opportunity for small businesses to scale up quickly on the technology curve in areas such as data, semiconductors, productivity tools and software.

We see opportunities especially in semiconductors and software. At this juncture, China still needs to rely on global semiconductor supply chains but is more equipped today with local talent and also technical know-how for basic and entry level technology products. We think the opportunity for catch-up bodes well for a promising revenue growth story for many Chinese firms in the Information technology space.

Positioning for earnings growth

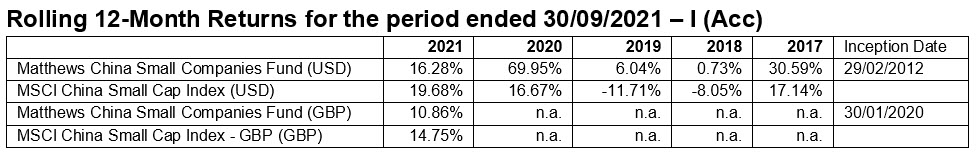

Given these various opportunities and volatility in the market, the Fund has been more active this year. 2020 was a strong year for Chinese small caps, with the MSCI China Small Cap Index up 27.21% in the calendar year and the Matthews China Small Companies Fund posting returns of 77.70%.4 Much of this performance was driven by companies in three sectors, namely information technology (IT), health care and consumer staples.

Year-to-date through September, it has been a different story. In terms of sectors, materials and utilities have generated attractive performance. The materials sector has evolved to meet the needs of a changing economy: it is no longer commoditized and investors have noticed new opportunities in complex materials. Meanwhile utilities companies have benefited from an increased mix of renewable energy which has bolstered growth over the period. In our portfolio we see opportunities in clean-energy distributors.

As active managers we adjusted the portfolio throughout the year: In the first quarter of the year, we took profit from expensive areas such as IT, health care and consumer staples and repositioned into more attractively valued opportunities. Exposure to materials, utilities and financials has grown since the start of the year.

Financials as a sector has not been a stellar performer over the history of the small cap space, but year-to-date through September it has done well. We believe financials represent an overlooked sector in China’s equity markets despite maintaining a consistent pace of growth. From an investment perspective we see opportunities in investment banking, brokerage as well as Fintech.

Today, we see a wide dispersion in valuations across the market. Some parts of the portfolio remain relatively expensive, but these are largely in areas with secular growth such as new energy and productivity upgrades. Their longer-term trajectory remains very positive in our view, but we watch out for short-term volatility given valuations.

We balance the portfolio with exposure in what we believe are more attractively valued opportunities in logistics and supply side reform. In terms of sector allocation, IT continues to be largest overweight in the Fund, alongside industrials and financials, while real estate is the biggest underweight.

Finally, there is a wide valuation difference between onshore and offshore Chinese equities. Domestic Chinese A-shares have held up better than Hong Kong-listed Chinese stocks (H-shares) year-to-date through September. While discounts for H-shares have always been quite meaningful, at the beginning of October, dually-listed domestic A-shares were 45% more expensive than H-shares which experienced a larger sell-off.

We believe this is largely due to differences in perception and local investors having more confidence in their markets. In our view, H-shares are more attractive from a valuations perspective. Furthermore we believe that as capital markets open up more, H-shares may be increasingly bought by domestic China investors, and this may favor their longer term valuations.

Looking ahead, we believe earnings growth will be the main driver of performance rather than multiple rerating. While the broader China market has corporate earnings expectations at around 10%, companies in our portfolio expect to exceed that level.

There are many reasons why we think small caps will remain resilient: Not only are they are at the front and center of China’s economy when you look across metrics such as contribution to GDP, percentage of patents and innovation, but they are more insulated from trade and geopolitical affairs.

Small Companies are highly driven by domestic demand, and they tend to be asset-light and capital-efficient. As such, they are often nimble companies that can react quickly to a changing market environment. It is what makes China small caps a unique stock market.

1 Source: Bloomberg, data as of September 30, 2021

2Source: Homi Kharas and Meagan Dooley, “China’s Influence on the Global Middle Class,” Brookings Institution, October 2020

3Source: McKinsey & Company; McKinsey China Auto Consumer Insights 2019

4 Data in USD, I (Acc) for the Fund. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than the original cost. Current performance may be lower or higher than performance shown. Investors investing in Funds denominated in non-USD should be aware of the risk of currency exchange fluctuations that may cause a loss of principal. Performance details provided are based on a NAV-to-NAV basis with any dividends reinvested, and are net of management fees and other expenses. Source: Brown Brothers Harriman (Luxembourg) S.C.