China Rising

Portfolio Manager Winnie Chwang says the pieces are falling into place to make the investment case for adding exposure to China.

China is adjusting its COVID rules, easing back on its regulation drive and, for now, geopolitical tensions with the West seem to be in calmer waters. The negative headwinds that so aggressively reduced Chinese equity valuations in the past year would seem to be receding.

That’s not all. We believe many Chinese companies are getting to grips with the margin pressures imposed by surging commodity prices and this should bode well for second-half earnings. In addition, valuations of Chinese equities remain enticing in the aftermath of the past year’s sell-off. And from a macro perspective, unlike the West, China doesn’t have an inflation problem per se. It can inject stimulus into the economy. Below we lay out the case for why we believe the rise in Chinese equities is set to gain traction.

Removing roadblocks

China’s zero COVID policy has been the dominant headwind for Chinese companies in recent months. The government’s efforts to contain the omicron strain with city-wide lockdowns has severely impeded the ability of companies to do business and for consumers to spend. Another big challenge for Chinese companies, and businesses around the world, has been trying to absorb higher prices for energy and raw materials triggered by Russia’s war in Ukraine.

These negative headwinds have particularly impacted China’s domestic economy and those companies listed on its mainland A-Shares market—many of which operate in high volume sectors where competitive margins and advantage are critical. The impact of these challenges will be clearly seen in financial top and bottom lines in the second quarter but we believe all eyes will be on corporate outlooks.

Looking ahead, we have reasons to be optimistic. On the pandemic, China is targeting improving vaccination rates among its elderly and it is beginning to transition its pandemic policies. In June, it announced it will halve the required quarantine time for inbound travelers—a policy that has been a major roadblock for overseas business travel. Of course, lockdowns can return but we think the government recognizes the economic impact these measures have had and is trying to make them more progressive.

In terms of cost pressures, we believe Chinese corporations have to endure some pain but are now trying to protect their margins with strategies including raising prices. China has such entrenched supply chains that there might be opportunities for companies to raise prices without the risk of losing meaningful business.

Attractive entry point

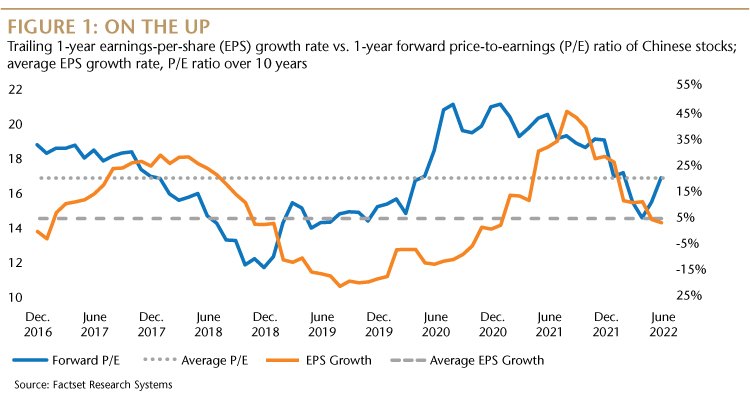

Let’s take a look at valuations. The market valuation of the MSCI China Index has dropped by about 25% over the past year and on average China small cap price-to-earnings (P/E) multiples have fallen by around 14%. All this while year-on-year earnings-per-share (EPS) growth of the China index is estimated to be about 16% and more than double that for the China small caps index at 35%.

Negative sentiment for the reasons described above has resulted in Chinese equities with good cash generation, healthy bottom lines and sound prospects being sold off often in equal measure to weaker businesses. Across markets, growth stocks, with the potential for greater earnings tomorrow, have experienced an aggressive repricing in the past year as inflation has taken hold. But we believe many growth companies in China are sound businesses. The fundamentals are improving and they have strong routes to increased profitability. We expect corporate earnings to recover as China’s economy opens up and domestic inflation stays under control. As a result, there is an opportunity for P/E ratios to re-rate to reflect positive changes in earnings.

Bigger positives

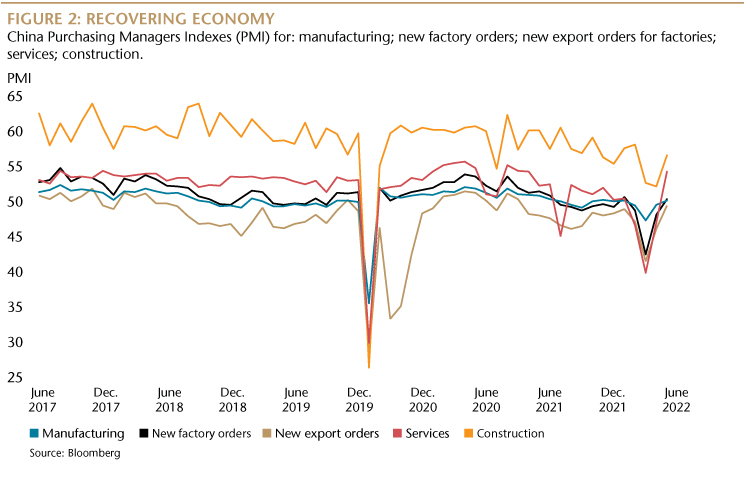

From a macro-economic point of view, China hasn’t instigated any bazooka-style easing measures. It has lowered mortgage and loan rates and reduced the Reserve Requirement Ratio (RRR). At the local level it has introduced tax rebates for corporations and small businesses, and coupons, mortgage aid and tax discounts for big ticket purchases like cars for consumers.

In the near term, we expect more fiscal easing and infrastructure spending. The latter is an effective tool and its impact could be magnified given that construction projects have stalled over the past couple of years. The combination of fiscal spending and consumer and corporate support could be a very positive tailwind for domestic Chinese stocks.

Key industries for China’s economy

The health of the property market is very important to the Chinese government as it’s a meaningful part of the economy. After the challenges of recent years, as the government intervened to address speculative activity and over-indebtedness among developers, we are starting to see a transition to higher quality growth.

Consumer internet platforms are another key area. While the government has moved to regulate what it saw as irresponsible deployments of capital among online consumer enterprises it is now keen to see these companies grow in a sustainable and profitable way. The easing of regulatory actions is also welcome for the offshore market—Chinese equities listed in Hong Kong and the U.S.—which features a number of large, fundamentally strong internet stocks. Fintech, gaming and online education stocks were also subjected to aggressive rule-making and sentiment toward them may also recover given that stock prices have more than priced in worst scenario outcomes.

Key secular investment opportunities

For investors, we see distinct long-term, secular trends that make China a strong proposition for emerging market portfolios.

- Connectivity and tech innovation

This is a trend with vast opportunities and multiple growth sub-trends as Chinese domestic companies build on and expand their capability and vie with the products and services of western corporate leaders. We see Chinese companies delivering strong growth across productivity tools and software as well as data and semi-conductors. - Environmental and renewable energy

China has significant climate commitments, not least its pledge to be carbon neutral by 2060. The government is prioritizing transitioning the economy into a less pollutive one while maintaining stability and growth. As a result, we see strong potential in companies involved in renewable energies, batteries and electrification, and new clean energy infrastructures. - Health care

Given China’s aging population, health care is an area with large long-term potential, particularly in biotech and medical devices. We are exercising caution in the short term because of the government’s current drive to lower drug prices. Nevertheless, health care is a secular trend with the opportunity for the development of more innovative businesses in China.

- Smaller companies

We also believe there are significant opportunities among small companies in China, particularly since the universe has a good representation of secularly growing areas in China. Chinese small caps is also a universe that provides deep liquidity. Over 80% of Chinese small companies are listed on the mainland A-Shares market which is six times as liquid as the Hong Kong market.

Silver lining

We also think there is a strong theme at play that will push productivity and innovation across China. The Chinese economy has been overly reliant on imports, for example in hardware technology, and the government is trying to bolster some domestic capabilities. This concern is encouraging the acceleration of new product development across sectors—from specialty chemicals for industries like manufacturing, automotives and aerospace, to knowledge-based industries like IT, tech hardware and software. China’s chip industry, for instance, is expanding faster than any other region as mainland tech firms increasingly seek domestic alternatives for their components.

This environment is stimulating and enabling small domestic companies in China to up their game and compete against the products of large multinationals. In addition, industries like robotics and automation are growing to support the expansion of these domestic enterprises.

China’s transition to be a more self-sustainable economy won’t be easy but given the uncertainties at the geopolitical level there is an incentive for China to stay focused on domestic growth. It’s a priority of the Chinese government and there is also a willingness among Chinese citizens and businesses to buy locally to support their economy and improve their own prosperity. Outside of this, international relations between the U.S. and China clearly remain very fluid. They have their own trajectory and variables and this bilateral dynamic will remain an ongoing external risk of investing in China and indeed Asia at large.

Promising path

In conclusion, the Chinese government is sensitive to the economic costs of its zero COVID policy and the headwinds that have battered its markets in recent months. China’s President Xi Jinping is expecting re-election for a third term at the National Congress later this year and the government is standing by an annual GDP growth target of 5.5% for 2022. While China won’t be immune to rising costs and a slowing world economy, its government is all in on a commitment to deliver strong and steady growth for its citizens.

The fundamentals of the many promising growth companies in China remain. Consumer demand is healthy and the government stands ready to add stimulus to its economy. That’s a good premise for the long-term growth we see taking hold in China that we believe investors would do well to get exposure to.

Key Positive Indicators

- Mainland market: easing of COVID rules will boost sentiment

- Offshore markets: easing of regulation will improve sentiment

- Valuations: Chinese equities may be at or near the bottom

- Abating of geopolitical concerns

The Risks

- Surging commodity prices are pressuring corporate margins but Chinese companies have room to raise prices

- Geopolitics won’t go away but it’s important not to be distracted. It doesn’t affect the prospects of Chinese companies

Tailwinds

- Many companies on the mainland market are embedded into domestic and global supply chains

- China has strength across sectors, from components for cell phones, car batteries and wind turbines, to materials, chemicals and manufacturing

- China does not have an inherent inflation problem and can implement fiscal and monetary stimulus

Takeaway

China equities, which generally offer attractive valuations, may be poised to benefit from a corporate earnings recovery, more fiscal and monetary stimulus, and a recovery in positive sentiment.

Winnie Chwang

Portfolio Manager

Matthews Asia

Definitions:

MSCI China Index: measures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges.

Price-to-Earnings: a ratio for valuing a company that measures its current share price relative to its earnings per share.

Earnings-Per-Share (EPS) Growth: calculated as a company’s profit divided by the outstanding shares of its common stock.