Discover Growth

Why we believe small companies present key opportunities to tap into the heart of innovation and expansion in emerging markets.

Key Takeaways

- In our view, the universe of small companies in emerging markets is vast, deep and diverse.

- Small-cap companies in emerging markets can mirror some of the traits of developing countries—fast-growing, unpredictable and bursting with potential.

- One of the main risks to manage, in our opinion, is liquidity. It’s crucial that small companies progress through operational milestones to help build cash flow and strengthen balance sheets.

- China has its challenges and but let’s not forget the sheer scale of its economy and there are an abundance of quality companies for investors to get exposure to, in our view.

The allure of small companies is in many ways rooted in the notion that less can offer the prospect of more. Businesses setting out on a path of innovation, ingenuity or bold expansion can offer the tantalizing possibility that they will become established, cash-rich, household names with potentially formidable competitive moats.

Across the globe, the landscape for small companies is, in our view, richest among emerging markets. These often undiscovered companies can mirror the economic profiles of the countries they are located in—fast growing, unpredictable and bursting with potential. And while it’s been a tough time for some emerging markets, notably China, we believe the nurturing potential and opportunities these economies can provide for smaller companies remains intact. In fact, in the post-COVID years, while we have seen high interest rates and a strong U.S. dollar dominate the macro environment, emerging markets small-company equities have thrived. And as we enter a period of falling U.S. rates and more accommodative global monetary policies, tailwinds may increase for small companies.

The qualities of small-cap companies

Let’s step back and look at some of the parameters in which small companies operate in emerging markets. Firstly, the road to expansion can be very fast. A widget-maker’s product can align with exploding domestic consumer demand or get snapped up by corporate giants in developed markets. Take Sunny Optical, for example. The Hong Kong-listed manufacturer of optical-products for phones and cameras is valued at around US$10 billion today. A decade ago, its market cap was approximately US$1 billion.1 Similar rates of growth can be seen in other markets like India and Vietnam where infrastructure spending and consumer markets are expanding rapidly.

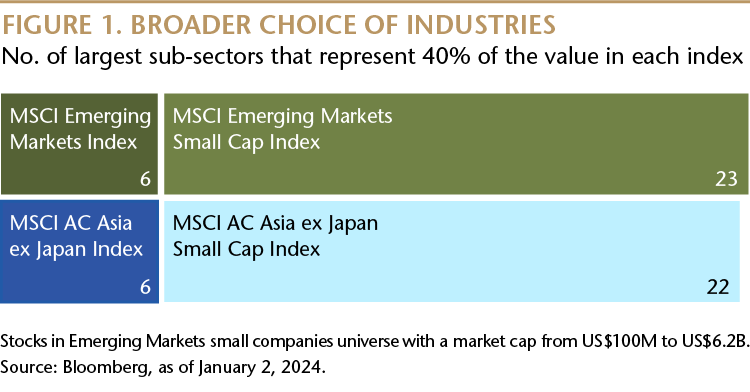

The second thing to bear in mind is that the universe of small companies—often defined as publicly-listed businesses with market values of between US$100 million and roughly US$6 billion—is vast, deep and diverse. Small caps can be found in a multitude of sectors and industries, offering investors the potential to get exposure to nascent and fast-growing themes. In the MSCI Emerging Markets Index, for example, around 40% of value resides in six sub-sectors. In comparison, 40% of the MSCI Emerging Markets Small Cap Index sits across 23 sub-sectors, including pharmaceuticals, real estate development and industrial machinery.

Another key characteristic of small-cap companies is that they often can be found in markets that are at differing stages of the economic cycle. This trait has been made more pronounced as industries and segments have recovered from the pandemic at different rates. Most emerging markets didn’t provide the kind of stimulus that development markets did so consumers and businesses have been getting back on their feet using their own means. Technology-skewed firms, for example, have in general been swifter to recover while many consumer-facing business are only now starting to fire on all cylinders.

Small businesses, by nature, can also be left alone by political tensions and regulatory interventions. In China, for example, a regulatory clampdown on large-cap behemoths in recent years has provided a relative tailwind for small caps in that country.

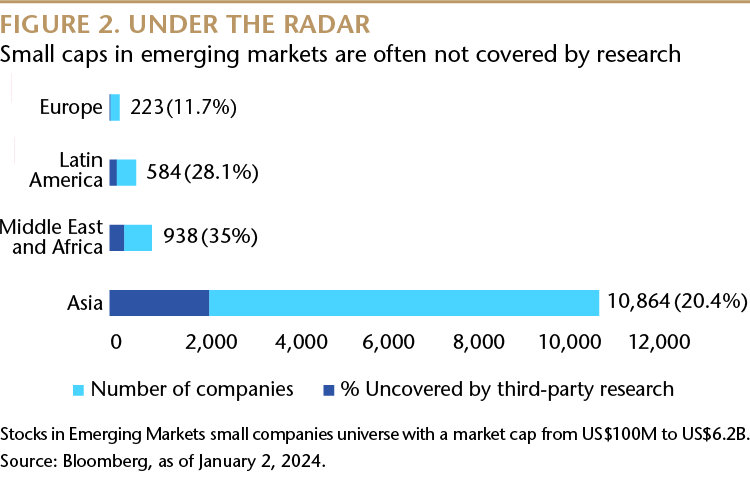

One of the most enticing attributes of small companies, in our view, is their patchy research coverage. Many emerging markets small-cap stocks aren’t covered by third-party analysts. As a result, they are often undervalued and under the radar of market participants. Some investors may interpret a lack of analyst coverage as an indication of higher risk but for the active portfolio manager, we believe it’s an opportunity to find mispriced stocks and realize value.

Hunting for small-cap opportunities

In our view, the key to finding robust, alpha opportunities among emerging markets small caps is in-depth, on-the-ground, fundamental research and careful portfolio construction. In many respects, we would argue that smaller companies’ operations can be relatively transparent as they tend to be single-vertical, single-country businesses as opposed to large caps which can often be complex multi-vertical, multi-country conglomerates.

Among the most important attributes a small-cap business can have are pricing power, visibility of earnings, good capital allocation and capital structure, and an addressable market. Companies cannot grow earnings sustainably through cost optimization alone. To deliver above average revenue growth for a long period of time, a business needs to address large and/or fast-growing market opportunities.

Of course, small-cap companies, with developing business models, evolving profitability and balance sheets, can inherently present higher risk for investors than bigger, established companies. That said, there are no guarantees for a business of any size. Large caps are concentrated in a handful of large sectors and in an event like the Global Financial Crisis (GFC), U.S. large-cap companies—dominated by financials and real estate—faced disproportionate turbulence.

Emerging markets have long provided a fertile hunting ground for smaller companies. And given the low research coverage and diversity of their universe, we think smaller companies present compelling alpha opportunities.

We believe one of the main risks to manage with small companies is liquidity. It is crucial that these businesses evolve and progress and pass through operational milestones. While small caps may have weaker balance sheets on average to bigger companies, their large universe means avoiding companies that don’t meet selection criteria often can be relatively straightforward to navigate. In an economic downturn or when financial conditions tighten, small companies generally find it harder to access capital compared to large companies. Seeking small companies with strong balance sheets, superior cash generation capabilities and low leverage ratios can effectively address these potential funding challenges and underlines the importance of fundamental research.

Shareholder liquidity also needs to be carefully managed with small-cap investing. It can vary depending on the prevalence of family shareholdings, retail-versus-institutional ownership, and between markets. China’s domestic A-shares market, for example, is relatively liquid compared with other emerging markets.

Small-cap China

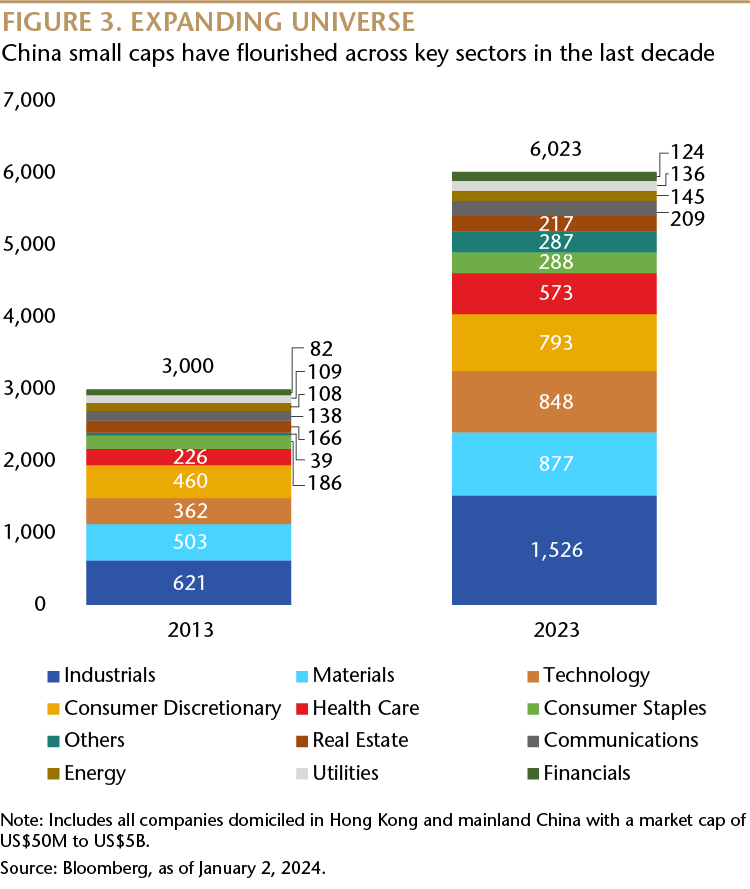

Small companies have always been an integral part of Asia’s economy and as capital markets have deepened the investment universe has grown considerably. A significant proportion of this growth has come from China. From 2013 to 2023 the number of Chinese small caps surged, most notably in the innovative sectors: from 362 to 848 in technology, from 226 to 573 in health care, and from 621 to 1,526 in industrials.

Clearly, China has its challenges. It’s the one key market where we haven’t seen a robust recovery from COVID. The economy has struggled to grow absent any significant fiscal stimulus from the government and it may be further buffeted by a potential economic slowdown in developed markets this year. The government is also still figuring out ways to stabilize its property sector and install some much needed confidence among businesses and consumers.

But China will recover, in our view, and we mustn’t forget the sheer scale of its economy. There are an abundance of quality companies for investors to get exposure to and, in many ways, China is a natural home for small-cap opportunities. Among urban employment, about 88% work in the private sector2, generally for small firms, and China’s small-cap universe is close to 6,000 companies.

Smaller companies in China are also a heartbeat away from some seemingly unstoppable secular trends, such as digitization and renewable energy. These trends are associated with expanding consumer markets and income growth, technology, manufacturing, and energy self-sufficiency.

Early engagement

Finding innovative companies early in their lifecycle can also be a critical source of alpha. We often establish contact long before an initial public offering (IPO) and work on getting to know management ahead of the potential exponential growth phase the company is about to enter.

Investment experience is key for enhancing our ability to select resilient and successful small companies in the emerging markets universe. When we analyze a new prospect, we draw heavily on our past sector and company knowledge. It’s essential to conduct in-depth company analysis—by interviewing management, visiting headquarters, factories and stores, as well as talking to clients, suppliers and competitors—while also working on a timeframe that can take advantage of any short-term volatility.

Emerging markets have long provided a fertile hunting ground for smaller companies. And given the low research coverage and diversity of their universe, we believe smaller companies can present compelling alpha opportunities. They can also provide direct access to high-growth domestic consumption sectors that typically cater to a fast-expanding and resilient middle class. In addition, smaller companies can offer an opportunity to invest in innovation and to partner with entrepreneurs who may well become future captains of industry.

Sources:

1CompaniesMarketcap.com; 2CEIC, as of December 31, 2022.

The information on the security mentioned is presented solely for illustrative purposes and is not representative of the results of any particular security or product.