The Fundamentals of Japan

Donghoon Han and Shuntaro Takeuchi explain why macroeconomic developments in Japan and the U.S., and its associated market volatility, don’t negate from the longer-term prospects of Japanese equities.

Key Takeaways

- The changing global macro landscape is bringing more market volatility but we believe the fundamentals of Japanese equities are strong and resilient.

- Japanese companies’ earnings profiles are generally healthy and their ability to increase dividends and buybacks, funded by better capital allocation discipline, remains.

- Market volatility can be navigated provided that investors have exposure to companies which offer defensive strengths as well as the ingredients for long-term growth.

- In our view, Japan’s investment potential is sector-agnostic with opportunities for alpha generation across cyclical, defensive and growth stocks, and in secular trends.

Many investors understandably are wondering where Japan’s equity markets are heading. The market had a good year through June. After that it changed. The Bank of Japan's hawkishly delivered interest rate increase on July 31 preceded the release of weak U.S. economic data. These combined to trigger an unexpected unwinding of Japanese yen carry trades which in turn wreaked havoc across global equity markets, particularly in Japan. The Nikkei 225, or the Nikkei Stock Average, fell 12.4% on Aug. 5, its biggest decline since the day after the U.S. Black Monday crash in 1987.

Japanese equities recovered much of their losses in August, but volatility remains. Soft U.S. economic data and ongoing concerns over sustainability of the artificial intelligence (AI) boom continue to trigger sharp equity movements and with it a strengthening in the yen. And, in our view, investors’ focus on macro issues looks likely to remain. Japan’s central bank has telegraphed that more rate rises can be expected which may further strengthen the yen while a U.S. interest rate-cutting cycle and a falling dollar could negatively impact sentiment toward Japanese exporters. Moreover, if economic indicators begin to suggest growing weakness in the U.S. economy, bigger concerns may gather over a slowdown in global trade upon which Japan is highly dependent.

Lost in Translation

So how does all this shape the prospects for Japanese equities? The first point to make is that while domestic and international market landscapes and macro environments are important and can negatively and positively impact investor sentiment, we know as experienced investors that a company’s fundamentals play a critical role in providing resilience and growth traits to help generate investment returns. So while Japan’s equity markets are sensitive to macro developments and are experiencing a period of volatility, the strong fundamentals of Japanese equities have helped to support the market this year. Year-to-date, in yen terms, the MSCI Japan Index has delivered a total return of 16.9%, and in USD terms, it has delivered 12.59% through Aug. 31.

We also often hear concerns that Japanese equities are too reliant on the export sector and that rising interest rates and a strengthening yen inevitably hurt earnings. However, we believe this correlation is less strong today. Exports have been, and still are, a significant component of Japan’s economy but currency sensitivity has almost halved over the past two decades as more Japanese manufacturers have built out capacity overseas and are delivering product to customers locally. An increasing part of Japan’s corporate currency sensitivity represents a “translation” of local currency rather than a “transactional” cost implying a change of competitiveness.

Japanese exporters are also relatively unlevered versus global peers and have limited variable rate exposure. So, in our view, interest rate rises in Japan wouldn’t dramatically change the cash flow allocation to debt or hinder growth investments like R&D, CapEx and M&A.

In addition, there are notable sections of Japan’s economy that are not exposed to export markets and are currency neutral, including domestic banks, real estate, retail and consumer staples, domestic IT services and recruiting solutions industries. And from a domestic consumption point of view, we believe there are grounds for optimism. After 30 years of deflation, price rises are beginning to take hold which is leading to positive real wage growth and the potential onset of a reflationary period.

“Amid debate over whether the U.S. is heading toward a slowdown or soft landing we would say it is prudent to consider companies in Japan that offer resilience as well as growth potential.”

For those Japanese companies that do export or have global operations there can also be tailwinds generated by interest rate and currency movements. In 2021, Japanese foreign direct investment (FDI) into the U.S. was over US$700 billion—more than Germany’s FDI or Canada’s FDI into the U.S. That indicates that there are many Japanese companies across multiple sectors that could benefit from U.S. rate cuts. A recovery in the U.S. housing market, for example, is one area that could boost Japanese companies that own home builders in the U.S., supply construction materials or run mortgage refinancing arms.

More broadly, if we take the view that lower U.S. rates may bring more CapEx appetite across manufacturing segments—like factory automation, capital goods and materials—where Japanese companies show leadership, then Japanese stocks which have seen a weakness in the short-term could start to show upside strength.

The Fundamentals of Japan

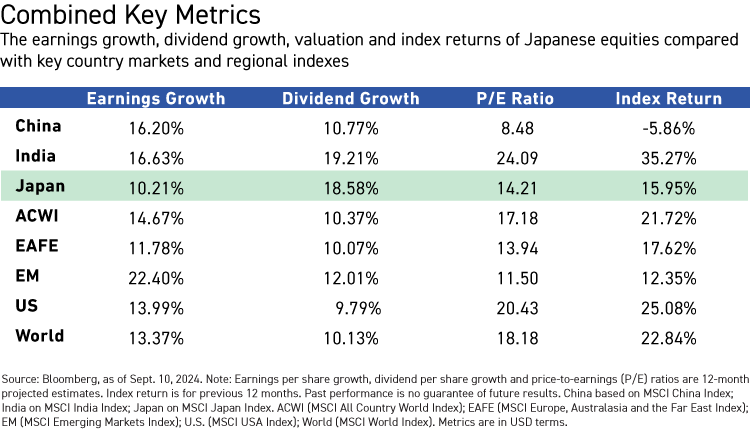

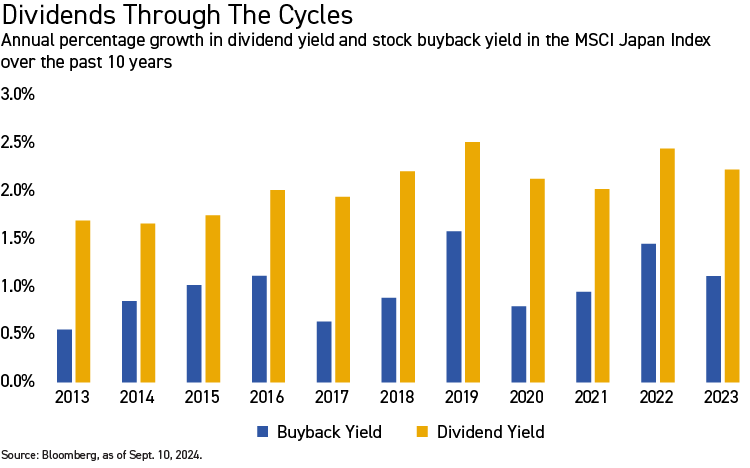

Recent foreign exchange movements haven’t significantly impacted the profitability of quality Japanese companies. And in many areas, for both domestic and export-orientated and international companies, we continue to think corporate profits will increase at a mid-to-high single digit percentage growth rate in yen terms, supplemented by healthy dividends and accelerating buybacks which could add another 2%-3% to total return potential. Japanese equity valuations are also compelling, at around 15 times earnings, which is around their 10-year average.

But we believe that the investment return potential in Japanese equities rests on several things in addition to earnings growth. Firstly, there is the opportunity to leverage compelling valuations. In periods of abrupt foreign exchange movements, for example, stocks tend to over-react and this volatility can enable long-term allocators to increase exposure to quality stocks at more attractive prices.

Secondly, over the past 12 months, we have seen Japanese companies embracing the government’s capital efficiency reforms. In many cases, it has been value stocks that have implemented the reforms and reduced cash on their balance sheets by increasing dividend yields and stock buybacks. We would say that these capital efficiency moves are now shifting to quality growth stocks with good cash flow, strong earnings and resilient business models. There are many quality stocks which are currently offering a return on equity (ROE) above market average but punching below their weight as they sit on significant amounts of cash on their balance sheets. As they improve their capital efficiency it’s reasonable to anticipate their ROEs increasing materially, which could result in valuation multiples expanding.

Thirdly, amid debate over whether the U.S. is heading toward a slowdown or soft landing, we would say it’s prudent to consider companies in Japan that offer resilience as well as growth potential. Stocks with resilient characteristics tend to have good cash flow and strong buying power which are key assets in a more challenging environment. They can be supportive in a downturn and be potentially well-positioned for economic recovery.

The Bottom Line

The strong fundamentals of Japanese equities remain, in our view. Many companies offer solid earnings growth as well as robust dividend yields and share buybacks which demonstrate a commitment to improving capital efficiency and allocation. But as active investors we are also cognizant of the Japanese market's sensitivity to the macro landscape and the broader, global economic cycle.

We also don’t look at investment opportunities in terms of secular or sector themes. We see opportunities across the board, be it in defensive consumer staples, in cyclicals like autos or in IT services, and in terms of valuation, earnings growth and managing risk.

While we anticipate more volatility ahead in Japanese equity markets and in other major equity markets, over the longer term we see a general improvement in ROE from Japanese companies and that in turn translating into improved valuations and improved equity returns. These are tailwinds that we think bode well for the case for investing in Japan over the next three to five years.

Cross-Sector Potential

- Our approach to the Japanese equity market goes beyond owning a company for its interest rate leverage or to mirror macro conditions, for example. We identify growth narratives across industries. We invest in businesses which display unique elements that we believe will enhance profitability and offer the potential for earnings-per-share (EPS) growth to surpass peers during both up and down interest rate cycles.

- In the case of financial services companies, banks and insurers, we can evaluate whether a business has long-term reinvestment opportunities that will lift organic growth and which can be funded by internal corporate reforms, such as sales of cross-shareholding assets. We think this approach enables us to find names which can offer more durable expansion of trading multiples in the long run.

- In more growthier areas, some investors and some of our peers tend to strongly favor mega-trends, such as generative AI and semiconductors. However, we are valuation sensitive and not excessively reliant on single themes. These segments have also generated volatility recently in part due to weak economic indicators, and movements in interest rates and currency markets. Volatility can be an opportunity but at the same time growth stocks need to show a resilience to macro headwinds.

- Year-to-date, domestic IT services and consumer discretionary businesses, particularly companies in apparel, have performed strongly. With Japan’s declining working population, companies are aggressively investing in digitalization to enhance per-capita efficiency across sectors. The shift to an increase in discretionary spending is also quite distinctive compared to other countries, as Japanese consumers begin to experience positive real wage growth after decades of deflation. We’re observing not only high-end brand spending but also widespread acceptance of price hikes without significant volume decline.

- There are many other unique growth stories, in our view. In manufacturing, for example, the penetration of hybrid powertrains is particularly beneficial and unique to the Japanese auto supply chain. And defense spending as a percentage of Japan’s GDP is accelerating at a faster clip relative to other peers. These segments also don’t necessarily trade excessive premiums to the market or their own histories and this encourages us to identify them more as value-to-growth opportunities.

Volatility: A Challenge and an Opportunity

Investors often ask how to best navigate volatility in Japanese equities. In our view, Japanese equities have always had higher sensitivity to macro developments and tend to react beyond what the fundamentals are telling us. Our investment strategy is focused on earnings growth and strong fundamentals. In periods of volatility these traits can provide resilience and can also offer an opportunity for us to bolster the quality of our portfolio with stocks we have conviction in.

While we can’t predict the actions of central banks or anticipate the scope of market reactions, we do know the companies that can offer the most resilience to changes in the macroeconomic landscape, as well as those that can potentially benefit, and we can position accordingly. We can also make judgements on the length of time we hold stocks according to the degree of sensitivity they have to interest rates and foreign exchange markets.

Shuntaro Takeuchi

Portfolio Manager

Matthews Asia

Donghoon Han

Portfolio Manager

Matthews Asia

Definitions:

Nikkei 225, or the Nikkei Stock Average: A price-weighted index comprised of 225 selected blue-chip companies traded on the Tokyo Stock Exchange.

MSCI All Country World Index (ACWI) is an equity index which captures large and mid-cap representation across 23 Developed Markets and 24 Emerging Markets countries.

MSCI Europe, Australasia and the Far East Index (EAFE) captures large and mid-cap representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada.

MSCI USA Index measures the performance of the large and mid-cap segments of the U.S. market.

MSCI World Index measures large and mid-cap representation across 23 Developed Markets countries.