The End of Zero-COVID and the Start of China’s Economic Recovery

Andy Rothman explains the three reasons why he’s now bullish on China after being cautiously optimistic.

Subscribe NowChina is back on a pragmatic path, with the lifting of zero-COVID and property market policies that throttled domestic demand in 2022. COVID cases are likely to continue to rise in the coming months, but that is unlikely to disrupt progress towards living with the virus, and an economic recovery in the second half of 2023.

Why I’m Bullish

I’d like to explain why I’ve gone from being cautiously optimistic about Xi Jinping returning to a pragmatic path, to now being bullish on China: Xi Jinping has, in recent weeks, given clear signals that he is returning to a pragmatic approach to COVID, to the economy, and to relations with the United States.

COVID Pragmatism

The return to pragmatism began soon after the end of the Party Congress, when Xi’s third term as leader was formally confirmed. In a November 11 speech, he announced 20 measures on COVID mitigation designed to reduce obstacles to normal life.

Since that time, four important things have happened. First, most zero-COVID restrictions have been abandoned in most places in China. Routine testing is no longer required, and the government has ended the forced quarantine of people who have COVID but are not seriously ill.

Second, the end of zero-COVID has resulted in a large wave of COVID cases across the country. Because frequent, mandatory tests have largely ended, the official case count is no longer a useful metric. (This is similar to most countries, where people who test positive at home rarely report those results to the government.) Anecdotally, however, it is clear that COVID is sweeping across the country, including Beijing, where the Party leadership lives.

Third, this wave of cases does not appear to have resulted in a spike in serious illness. For the whole country, there were only 147 cases classified as “severe” on December 12. Since Xi’s November 11 speech, only nine deaths have been attributed to COVID. This may reflect that the current variant of the virus circulating in China is less dangerous than earlier iterations, and that the domestic vaccine is providing significant protection. There is, of course, a risk that the impact of the virus changes and the health care system is overwhelmed, but that is not happening at this time.

Fourth, the government has begun to ramp up its campaign to raise vaccination rates, especially for the elderly. This is important because although by late November, 90% of Chinese had received two shots (compared to 69% in the U.S. and 88% in the UK), only 58% of Chinese had received a third jab (compared to 53% in the U.S. and 70% in the UK). Moreover, about 25 million Chinese over the age of 60 had not received any jabs, and 58 million older Chinese needed a booster.

Over seven days through December 12, a total of 5.7 million doses of vaccine were administered, compared to only 760,000 doses during the seven days prior to November 11. Much more needs to be done, and it is unfortunate that this second vaccination campaign did not begin much earlier, but the process appears to be finally back on track.

All of this adds up to a significant change in direction of policy, towards living with the virus, and away from zero tolerance for cases. It is very unlikely that this change in direction could be reversed next year.

Property Pragmatism

Xi also announced in November his intention to reverse several policies that had effectively shut down the residential property market. He endorsed new measures which encourage banks and trust companies to extend maturity for construction financing, as well as support for bond issuance by privately owned developers, both of which should improve cash flow and project completion. Government-directed banks have also cut average mortgage rates by 129 basis points (1.29%) since the start of 2022, and mortgage processing time has been reduced.

This pragmatic course correction should lead to a gradual, steady recovery in new home sales in the second half of 2023.

Focused On Growth

The return to pragmatism on COVID and property appear to be part of a coordinated effort to restore consumer confidence and jumpstart the economy.

This is consistent with what Xi said at the Party Congress in October. Xi said he is “focused on promoting high-quality development,” and that he wants to “bring per capita disposable income to new heights.” At the Congress, Xi said “development is our Party’s top priority,” and that “we will provide an enabling environment for private enterprise.”

It's also worth noting that in a December 9 speech, Premier Li Keqiang said his government will take measures to promote consumption, which he called “the main driving force of economic growth.” Li reiterated support for the property market, and he signaled a lighter regulatory approach towards on-line platform companies. “The platform economy has promoted consumption and employment,” Li said, adding that the government “supports the healthy and sustainable development of the platform economy.”

This more pragmatic path will be bumpy, and implementation may stray off course during the winter as cases rise and local officials struggle with the new direction. Consumers may be free from lockdowns, but at least for the coming few months, a wave of COVID cases, although mild, may dampen sentiment and activity. The need to vaccinate many millions of older people is also a challenge.

But, short of a public health catastrophe, it is hard to imagine that the Party will return to its zero-tolerance approach, especially since the change in policy direction was personally announced by Xi, and because the virus is now so widespread in China that lockdowns would clearly be pointless.

Washington Pragmatism

Another reason I’m bullish is that when Xi and Biden met in Bali in November, both made serious efforts to put a floor under the rapidly sinking bilateral relationship.

I do not expect U.S.-China relations to improve significantly, in large part because of domestic politics in the U.S., but the odds of further deterioration were reduced as a result of their first in-person meeting since Biden was elected president.

After the meeting, Biden said, “I do not think there’s any imminent attempt on the part of China to invade Taiwan.” That is an important change from what his Secretary of State told an audience at Stanford a few weeks earlier.

In Bali, Biden also said, “I absolutely believe there’s need not be a new Cold War,” and he said about Xi, “I think that we understand one another.”

In response to a reporter’s question, Biden said, “And do I think he’s willing to compromise on various issues? Yes.”

According to the official Chinese media, Xi’s message to Biden was also constructive. Xi said he “takes very seriously” Biden’s pledge to continue with a One-China policy, and Xi said “China and the U.S. need to have a sense of responsibility for history [and] put the relationship on the right course. . . The successes of China and the U.S. are opportunities, not challenges, for each other.”

The two leaders agreed to increase the level of dialogue between their advisors, and Xi added that he will “unswervingly pursue reform and opening-up, and promote the building of an open global economy.”

It is also positive that it appears that inspectors from the U.S. Public Company Accounting Oversight Board, or PCAOB, completed their initial audits in Hong Kong without incident— I’ve heard no rumors that they didn’t get all the access they needed—which means Chinese ADRs are likely to continue trading in New York. This represents another signal from Xi that he wants to stabilize relations with Biden, and does not want financial decoupling from the U.S.

I believe U.S.-China relations will remain tense, but conflict, including over Taiwan, will be avoided.

China’s economy is driven by domestic demand, and active investment in Chinese companies selling goods and services to Chinese consumers mitigates the impact of political tensions.

Optimistic for a second half recovery

These developments over the last few weeks—on COVID, property and relations with the U.S.—leave me feeling very optimistic about prospects for the Chinese economy, especially after the end of the winter flu season, when COVID cases are likely to subside. I expect the macro data to remain weak in the first half of 2023, before a gradual recovery begins in the spring.

I understand that some may be skeptical about whether Xi will follow through on these three issues, but in my view, these pragmatic paths are all in Xi’s own self-interest.

With these recent decisions, Xi has acknowledged that, in the past, pragmatic policies have made China rich and kept the Communist Party in power, and that pragmatism is the best course for his country’s future, and for his own legacy.

Three Things to Keep in Mind

As we continue to track milestones on this path to pragmatism, there are three things investors should keep in mind:

First, China is likely to remain the only major economy engaged in serious easing of fiscal and monetary policy, while much of the world is tightening.

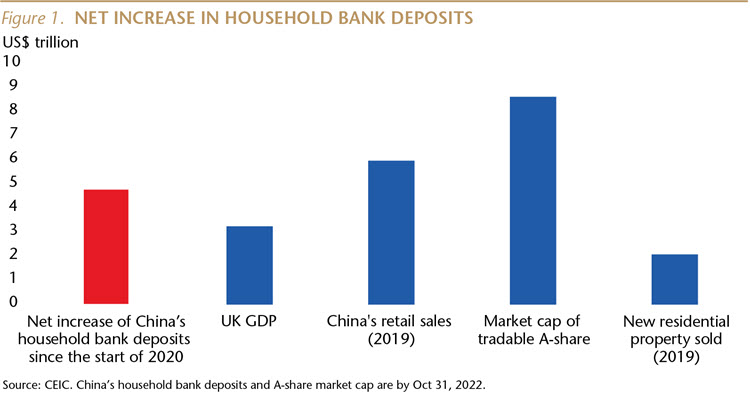

Second, Chinese households have been in savings mode since the start of the pandemic with family bank balances up 42% from the beginning of 2020. The net increase in household bank accounts during this period is equal to US$ 4.8 trillion, which is larger than the GDP of the UK.

Third, those funds should fuel a consumer rebound in China and a recovery in mainland equities, where domestic investors hold about 95% of the market.

Andy Rothman

Investment Strategist

Matthews Asia